Check Fraud Chase

A bit of a stir went around social media, you know, with many folks talking about a supposed way to get what seemed like free money from Chase bank ATMs. This whole thing picked up a lot of steam, especially on platforms like TikTok, where videos shared what some believed was a simple system error. People were, it seems, convinced they had stumbled upon a clever trick, a kind of digital loophole, that would allow them to pull out cash after putting in checks that might not have been, well, entirely real, or perhaps after asking for rather sizable loans. It truly looked like a straightforward path to getting some extra funds, just a little something for nothing, or so the story went.

Yet, the bank itself, Chase, saw things rather differently, as a matter of fact. They made it quite clear that what was being called a "glitch" by some social media users was actually something else entirely. Instead of a harmless system hiccup, the bank described these actions as acts of check fraud. It was a serious matter, they explained, not just a temporary technical issue that people could just take advantage of. The bank has been looking into these situations where individuals might have been part of this online trend, and they've been passing information along to law enforcement, too it's almost a given.

So, what started as a viral sensation, a quick way to get some cash, is now turning into a rather serious situation for many people. Customers who apparently took money from Chase bank ATMs using this particular scheme, the one that got so much attention over the summer, could very soon find themselves needing to send quite large sums of money back to the bank. JPMorgan Chase, which happens to be the biggest bank in the United States, has even started taking legal action against some of these customers, saying they improperly took funds by taking illegal advantage of what was a temporary technical issue that came and went, you know, pretty quickly.

Table of Contents

- What Was This Chase Check Fraud Situation All About?

- The Viral Spread of the "Glitch" Idea and Chase Check Fraud

- Why Was It Not a "Glitch" but Actual Check Fraud?

- The Bank's Stance on the Chase Check Fraud Incidents

- What Are the Repercussions for Those Involved in Chase Check Fraud?

- Lawsuits and Repayment for Chase Check Fraud

- How Can You Guard Against Becoming Part of Check Fraud?

- Steps to Take Before Reporting Potential Chase Check Fraud

What Was This Chase Check Fraud Situation All About?

The whole thing with Chase bank and what people called an "infinite money glitch" started gaining traction, you know, around the beginning of 2024. It was quite a phenomenon, with people on social media, especially TikTok, sharing videos that suggested they had found a way to get cash from ATMs without truly having the funds to back it up. The idea was that by putting in checks they wrote themselves, often for bigger amounts than they actually had, or by applying for large loans, the ATM system would somehow let them withdraw money right away. This created a sense of excitement, like finding a secret shortcut to getting free cash, which is that kind of thing many people might find appealing. It really took off, with lots of users trying to replicate what they saw others doing online, thinking it was a harmless trick.

People were sharing their experiences, making it seem like a simple, risk-free way to get money. They were, in a way, encouraging others to try it too, creating a sort of communal belief that this was just a system error that could be used to their advantage. The videos showed people at ATMs, seemingly getting money with ease, which, you know, looked pretty convincing to some. It was a very widespread trend, and it caught the attention of many, leading to a lot of activity at Chase ATMs across the country. The buzz around this supposed "glitch" was quite something, with discussions popping up on various platforms, not just TikTok but also places like X, as a matter of fact. This widespread sharing really helped the idea spread like wildfire, reaching a very large audience who might have been curious to see if it was true.

The Viral Spread of the "Glitch" Idea and Chase Check Fraud

The story of what happened with Chase and the check fraud incidents is pretty much tied to how quickly things can spread on social media these days. It all started with a few videos, you know, where people claimed they had found a way to trick the ATM system into giving them cash. These videos showed individuals depositing checks they had written themselves, often for amounts much bigger than what they had in their accounts, and then, supposedly, being able to pull out actual money right away. It was presented as a clever hack, a kind of loophole, that allowed people to get "free" money from Chase ATMs. This concept, of getting something for nothing, is that sort of thing that can really capture public imagination, and it did.

- Pete Buttigieg Net Worth

- Rebel Wilson Net Worth

- Scarlett Pomers Net Worth

- Judy Greer Net Worth

- John Astin Net Worth

The videos quickly gained a lot of views and shares, becoming what people call "viral." This meant that many, many people saw them, and some were persuaded to try it out for themselves. The idea was that the ATM system had a temporary flaw, a "glitch," that didn't immediately recognize the checks as fraudulent, letting people withdraw funds before the checks could be properly processed and rejected. This encouraged customers at the bank to try to take advantage of what they thought was an easy opportunity. It created a situation where a lot of people, all at once, started trying to deposit fake checks for large sums, hoping to get cash out before the bank realized what was happening. It was, basically, a mass attempt to exploit what was perceived as a weakness in the system, all fueled by these trending social media posts.

Why Was It Not a "Glitch" but Actual Check Fraud?

Despite what some people on social media were calling it, Chase bank has been very clear that the whole situation was not a "glitch" at all. What happened was, in fact, an act of criminal check fraud. The bank has pointed out that while there might have been a temporary technical issue that allowed customers to withdraw cash from ATMs using checks that weren't good, this doesn't change the nature of the act itself. It’s a bit like finding an unlocked door and walking into someone's house; even if the door was left open, entering without permission is still breaking the law. The bank's position is that exploiting a system error to take money you don't have is not a clever trick, but a serious offense. This distinction is really important, as it moves the discussion from a simple technical fault to a matter of illegal activity, which is that kind of thing with serious consequences.

The very common definition of "check fraud" involves using checks in a dishonest way to get money or property. This can include writing checks from an account with insufficient funds, altering checks, or, as in this case, depositing fake checks with the intent to withdraw money that isn't truly available. So, even if the ATM system allowed the withdrawal to happen for a short time, the act of depositing a check that you know isn't legitimate, or one that you don't have the funds to cover, with the aim of getting money, fits the description of fraud. The bank made it a point to remind its customers that this "glitch" was actually an invitation to commit a crime. It was a very direct warning, letting people know that what they might have thought was a harmless way to get some cash was actually a path to legal trouble, you know, pretty quickly.

The Bank's Stance on the Chase Check Fraud Incidents

Chase bank has been very firm in its response to these incidents of what it calls check fraud. The bank has stated that it is fully aware of the situation and is actively reviewing all the instances where individuals might have taken part in this online trend. Their position is that these were not innocent mistakes or simple system errors, but rather deliberate attempts to defraud the bank. They are not just letting it go; they are taking concrete steps to address it. This means that for anyone who thought they were just exploiting a "glitch," the reality is turning out to be quite different, as a matter of fact. The bank sees these actions as criminal, and they are treating them as such, which is that kind of thing you would expect from a large financial institution.

The bank has also made it clear that they are working with law enforcement authorities. This means that the information they gather about these alleged fraudulent withdrawals is being passed along to police and other legal bodies. It's a serious step, indicating that the consequences for those involved could go beyond just having to pay back the money. JPMorgan Chase, being a very large bank, has the resources and the legal standing to pursue these matters. They have begun filing lawsuits against customers, saying that these individuals improperly took funds by taking illegal advantage of a temporary technical issue. This shows their commitment to recovering the money and holding those responsible accountable for their actions, you know, pretty much without exception. They are not just warning people; they are acting on those warnings.

What Are the Repercussions for Those Involved in Chase Check Fraud?

For those who apparently got caught up in this social media trend and withdrew money from Chase bank ATMs using the scheme that became so popular, the consequences are starting to become very real. It's not just a matter of the bank being upset; there are significant financial and legal repercussions. The bank is making it clear that the money that was taken needs to be returned. This means that customers who allegedly took money fraudulently using this illegal scheme could soon find themselves needing to send quite large payments back to the bank. These aren't small amounts either; JPMorgan Chase is claiming that hundreds of thousands of dollars were stolen following this technical issue that went viral, which is that kind of sum that can really impact a person's life.

The bank is pursuing these matters with a good deal of determination. It's not just a polite request for the money back. JPMorgan Chase has actually started to file lawsuits against people who exploited what was called the "infinite money glitch" this summer. This means that individuals are being taken to court, and if the bank wins, they will be legally compelled to pay back the funds. This is a much more serious situation than just having an account closed or a card deactivated. It involves legal proceedings, which can be very stressful and costly, even if you don't end up owing money. It truly shows the bank's resolve to recover what it believes was taken from it, and to deter similar actions in the future, you know, pretty strongly.

Lawsuits and Repayment for Chase Check Fraud

The situation for customers who were involved in the viral check fraud trend at Chase is becoming quite serious, with the bank taking direct legal action. JPMorgan Chase, which is a very big name in banking, has started suing customers for what it calls check fraud. They are stating that these individuals improperly took money by illegally taking advantage of a temporary technical issue that gained a lot of attention. This means that if you were one of the people who withdrew money from Chase bank ATMs using this scheme, you could very soon be facing a legal demand to pay back a hefty sum. It's not just a warning; it's actual legal paperwork being filed against individuals, which is that kind of thing that can be quite unsettling.

The lawsuits are a clear sign that the bank is not just going to let this go. They are actively working to get back the funds they believe were stolen. This could mean that people who thought they got "free" money will now have to cut sizable payments back to the bank. The bank's message is quite simple: what was taken needs to be returned. This is happening now, with the bank taking people to court to recover these alleged losses. It’s a pretty direct consequence of participating in a scheme that was presented as a harmless glitch but was, in the eyes of the bank and the law, a criminal act of check fraud. So, if you were involved, you know, it's very likely that you'll hear from the bank's legal team.

How Can You Guard Against Becoming Part of Check Fraud?

It's always a good idea to be very careful when you hear about things that sound too good to be true, especially when they involve getting money easily. The Chase check fraud incident serves as a pretty strong reminder that what seems like a simple "glitch" can actually have very serious consequences. To protect yourself and avoid getting caught up in similar situations, it's really important to always question offers of "free money" or "system loopholes." Banks have very sophisticated systems to prevent fraud, and while temporary issues can happen, deliberately exploiting them is considered a criminal act. So, if you see something online that looks like an easy way to get money from a bank, it's usually a red flag, you know, pretty much every time.

One of the best ways to guard against becoming involved in check fraud, or any type of financial trickery, is to understand how legitimate banking works. Money isn't just "free" for the taking; it has to come from somewhere. If you deposit a check, the bank needs to verify that the funds are actually there before they become truly available to you. Any attempt to bypass this process, especially by using checks that aren't valid, is what banks and law enforcement consider fraud. Staying informed about common scams and understanding that banks take these matters very seriously can help you avoid making choices that could lead to legal trouble. It's about being aware and cautious, you know, basically all the time, to protect your own financial well-being.

Steps to Take Before Reporting Potential Chase Check Fraud

If you ever find a charge on your account that looks suspicious, or if you think you might be a victim of check fraud or some other type of financial wrongdoing, there are a few things you should check before you report it. Reporting fraud can sometimes lead to your card being deactivated, which can be a bit of a hassle, so it's good to be sure. First, you should always confirm that the charge wasn't made by someone who is an authorized account holder. Sometimes, family members or trusted individuals might use your card with your permission, and you might just forget about it, you know, pretty easily.

Second, it's very important to make sure you haven't let anyone else use your card. Even if it's someone you trust, if they make a charge you don't recognize or approve of, it can still be a tricky situation. Before you call the bank to report something as fraud, just take a moment to think if anyone else had access to your card, or if you might have given permission for a purchase you've since forgotten. This little check can save you from mistakenly reporting a legitimate transaction as fraud and going through the process of getting a new card unnecessarily. It's a simple step, but it can make a good bit of difference, you know, pretty often.

So, to sum up, the whole situation with Chase bank and the viral social media trend really highlights how quickly misinformation can spread and the serious consequences that can follow. What many people believed was a simple "glitch" allowing "free" money from ATMs was, in fact, an act of check fraud, as stated by Chase. The bank is actively reviewing these incidents, referring them to law enforcement, and even filing lawsuits against customers who allegedly took money using this scheme. It's a clear reminder that attempting to exploit perceived system errors for financial gain can lead to significant legal and financial repercussions, including having to pay back substantial amounts of money. Protecting yourself means being skeptical of promises of easy money and understanding that banks treat such actions as serious criminal offenses.

- Delonte West Net Worth

- Donald Bellisario Net Worth

- John Astin Net Worth

- Ariana Grande Net Worth

- Fortune Feimster Net Worth

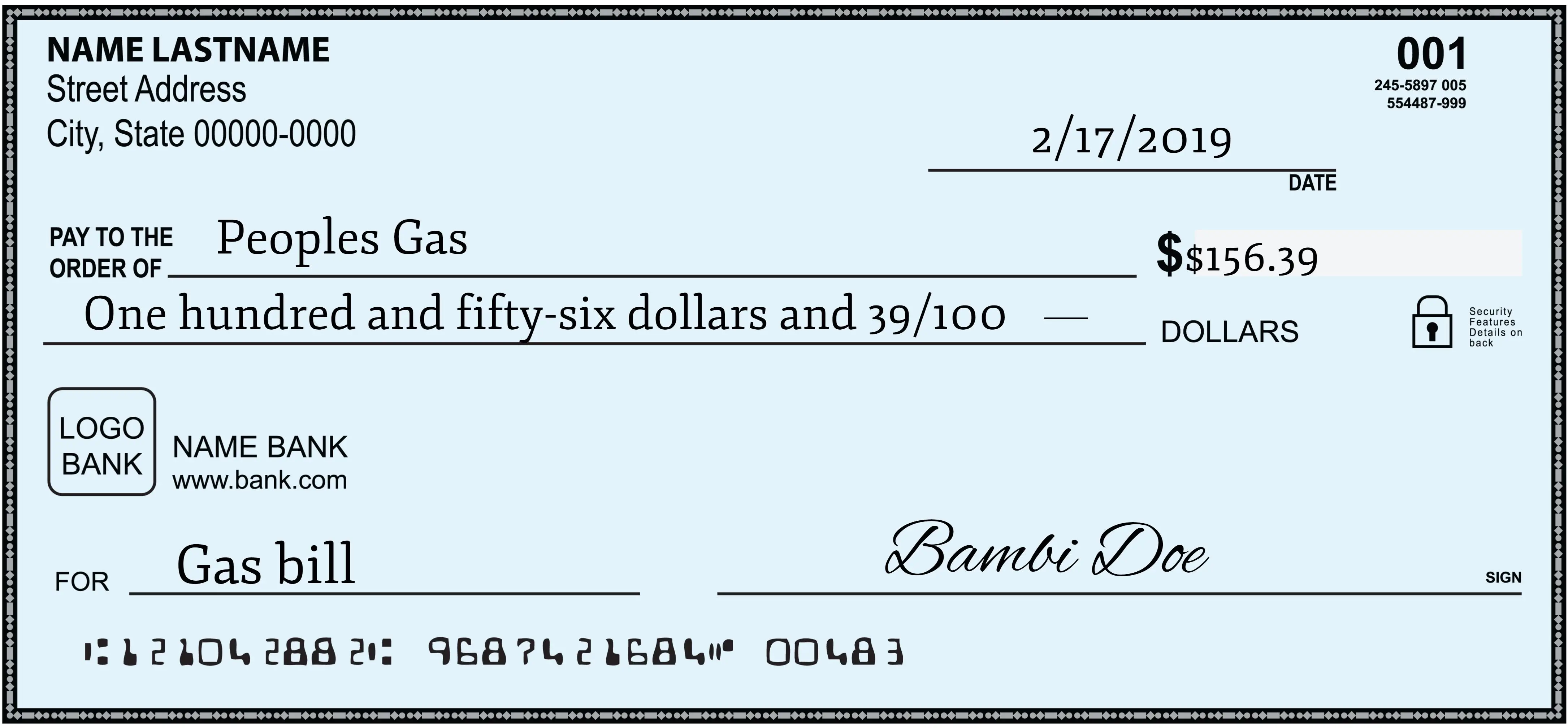

How to write a check | finder.com

Checkmark Powerpoint - ClipArt Best

Free Picture Of Check Mark, Download Free Picture Of Check Mark png